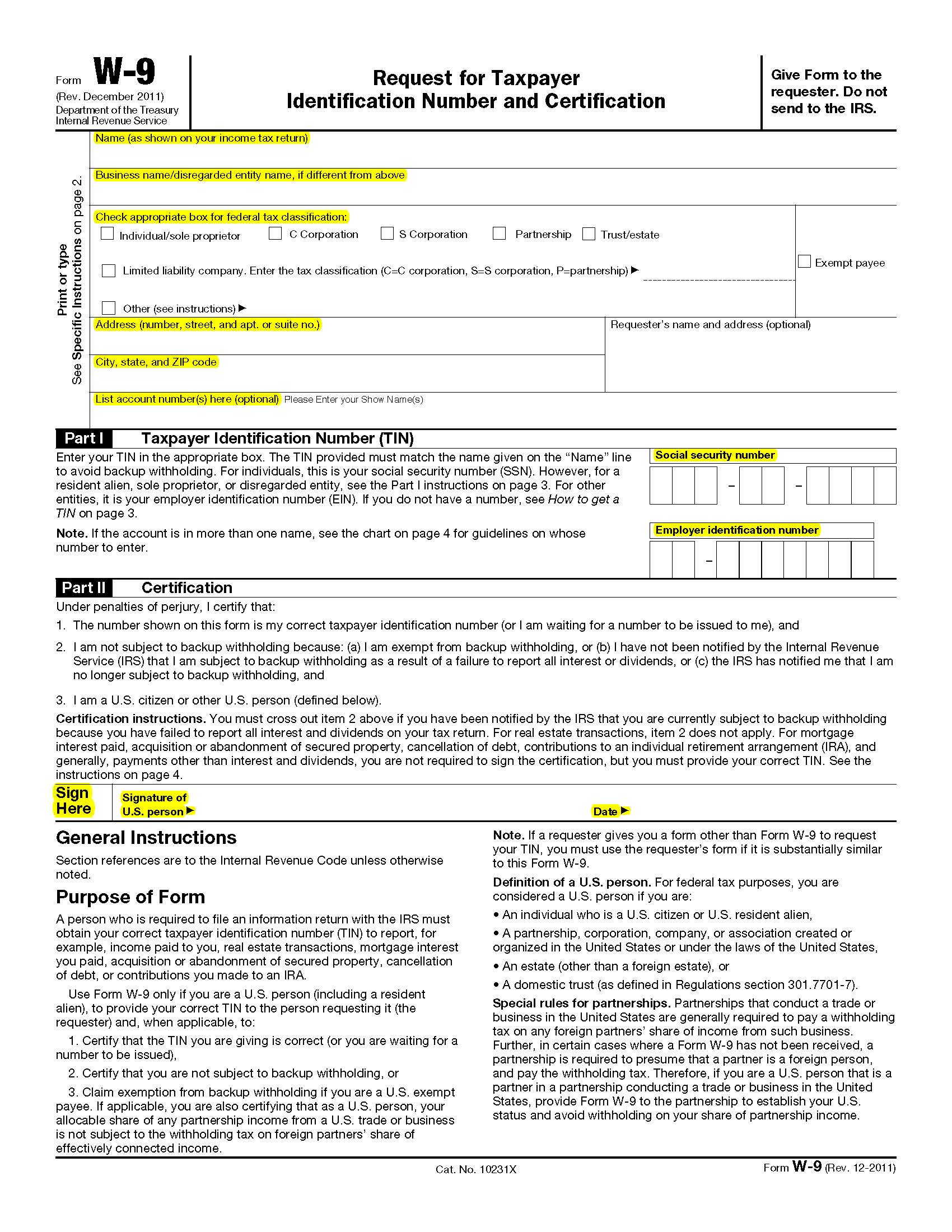

Why Is W9 Form Needed – This form is necessary for accurate reporting of payments a business made to the vendor, contractor, or business. This is the name that is shown on the individual's tax return. This field is either the name of an individual or it can be the name of. If a contractor fails to provide a valid tax id number, businesses may be required to deduct backup withholding on payments made to that contractor.

When to use a w9 form. Line 1, name of entity/individual. But because you're not sending it to the irs, you need to be careful about who exactly you send it to. This can be for owed income, real estate transactions, mortgage interest, acquisition or abandonment of secured property, cancellation of debt, or contributions made to an ira.

Why Is W9 Form Needed

Why Is W9 Form Needed

:max_bytes(150000):strip_icc()/filling-out-form-w9-3193471-v2-5b733961c9e77c00572ddf88-008a20358ffc40d98c451e6cdea43c21.png)

IRS Form W9 What Is It?

All about W9 Form What It Is, What It Is Used for, and How to Fill It Out

The W9 Requirement Libsyn

What is a tax form W9? Explore its purpose and when it is used in our guide Blog

W9 form Definition and how to fill it out Adobe Acrobat

Free IRS Form W9 (2024) PDF eForms

W9 Form Filing Philip Stein & Associates

W9 Tips Thread

:max_bytes(150000):strip_icc()/Investopedia-terms-w-9-edit-b52cc61f47044a94aa85d19ccdbeb7af.jpg)

What Is a W9 Form? Who Can File and How to Fill It Out

.webp)

How To Fill Out a W9 Form In 2024 — PDFliner's Detailed Guide