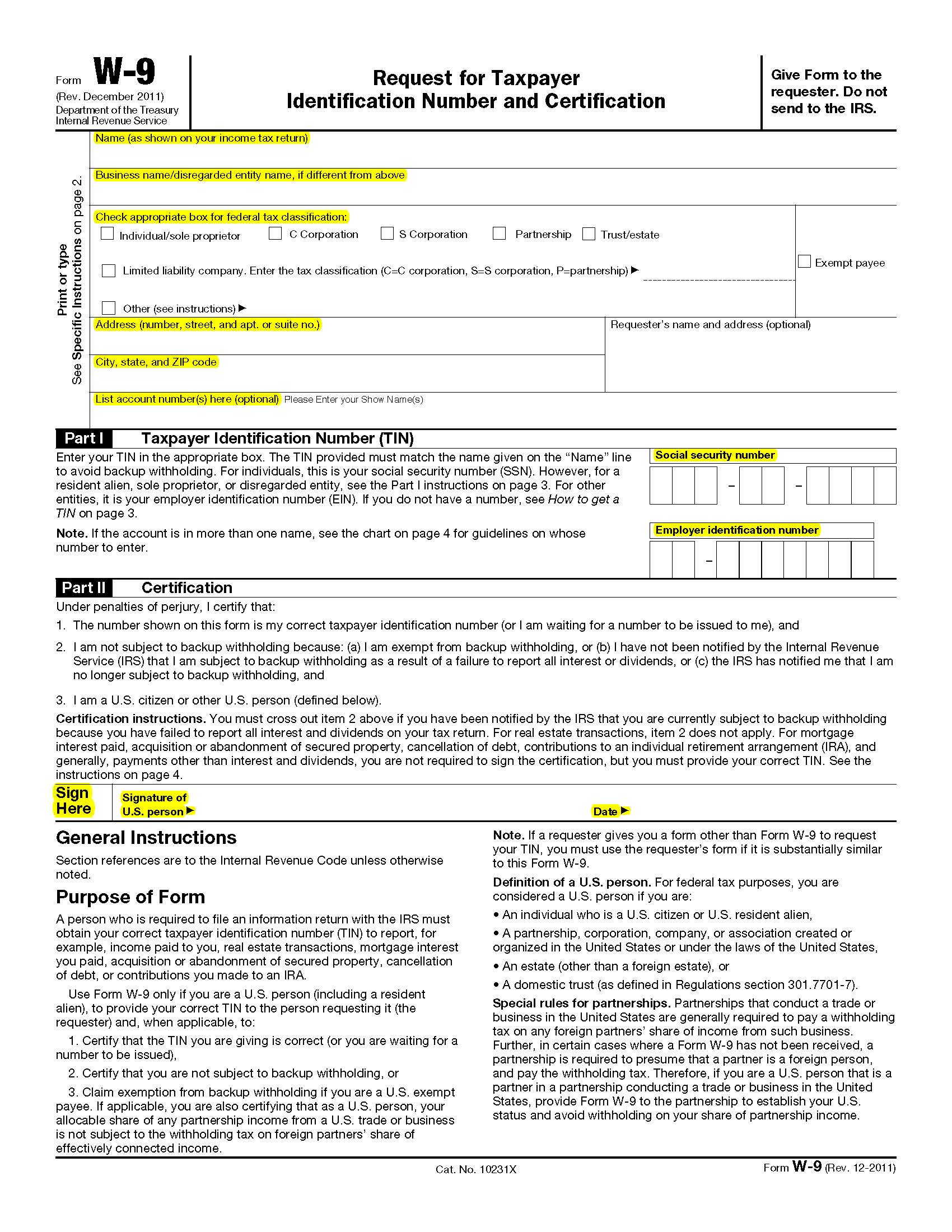

Why Do I Need To Submit A W9 Form – Failing to submit a w9 form when requested can result in significant financial and administrative repercussions for both payers and payees. When a business pays more than $600 to a single taxpayer during the year, it must submit an informational return to the internal revenue (irs) to disclose the payments. Without a correct tin, the payer must withhold 24% of the payment and remit it to the irs. The form requires an individual to provide their name, address, tax qualification, and withholding requirements.

For the payee, one immediate consequence is backup withholding. A vendor should submit a new w9 to the payer when their legal business form changes. This form serves as a guideline and gives the employer the information needed to fill out a form 1099 at the end of the year. Note that the vendor files a w9 form with the payer before the total amount paid in a calendar year is known.

Why Do I Need To Submit A W9 Form

Why Do I Need To Submit A W9 Form

What is a W9 and Do I Need One?

How to complete IRS W9 Form W 9 Form with examples YouTube

Form W9 for Nonprofits What It Is + How to Fill It Out

What Is a W9 Form? How to file and who can file

How to Fill Out a W9 Easy Steps and Tips UPDF

The W9 Requirement Libsyn

W9 vs. 1099 Form What is the difference? Skuad

:max_bytes(150000):strip_icc()/filling-out-form-w9-3193471-v2-5b733961c9e77c00572ddf88-008a20358ffc40d98c451e6cdea43c21.png)

IRS Form W9 What Is It?

What is a tax form W9? Explore its purpose and when it is used in our guide Blog

What Is a W9 Form? Who Can File & How to Fill It Out 2025