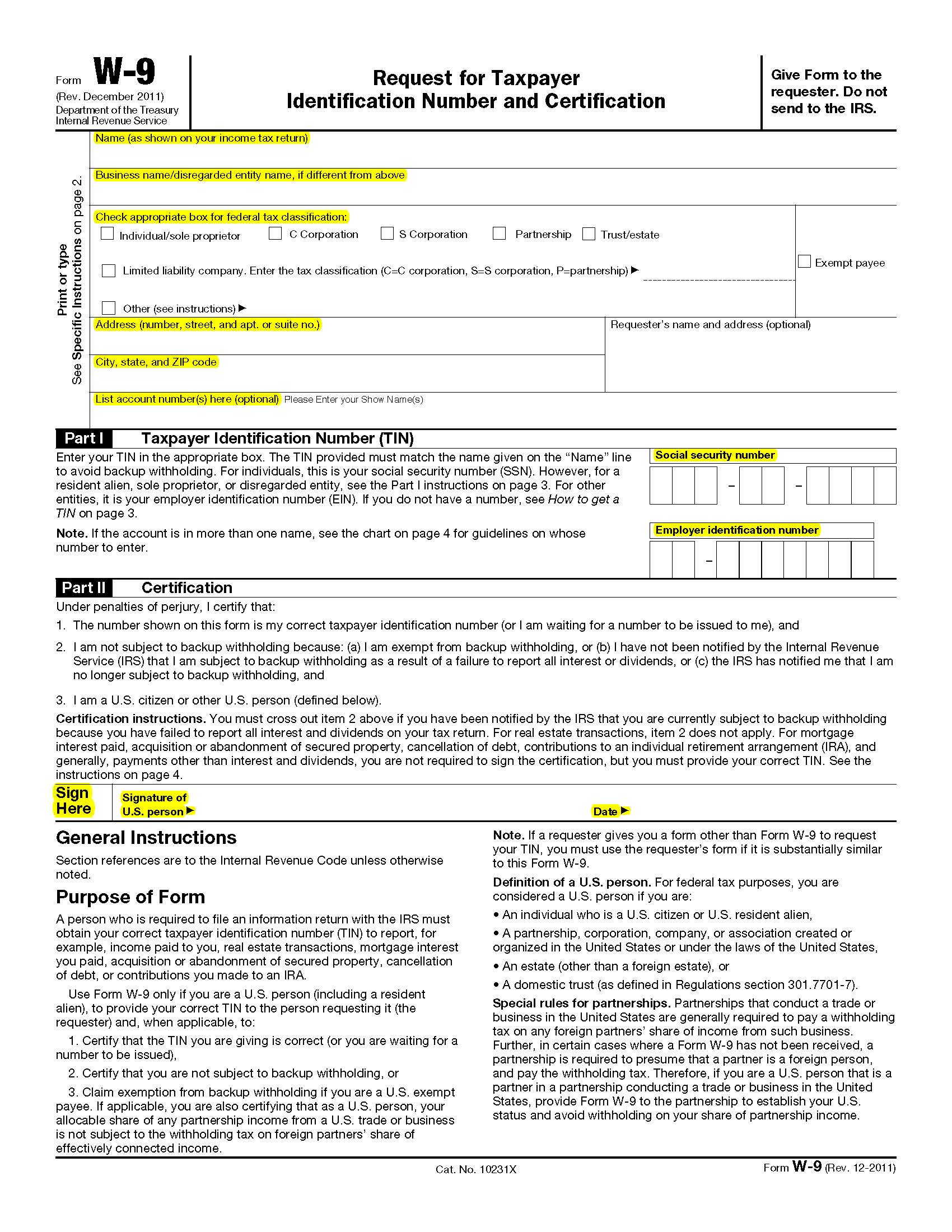

Who Uses A W9 Form – Providing a correct taxpayer identification number is important — it helps the irs determine who the taxpayer is. It helps gather taxpayer identification numbers (tins). Businesses need it to prepare and submit correct information returns. Tax system and are used at different stages of the payment and reporting process.

This form is mainly used for accurate tax reporting. Some tin examples include a social security number (ssn), employer identification number (ein), and individual taxpayer. The most common situation occurs when an independent contractor completes work for a company. [2] it requests the name, address, and taxpayer identification information of a taxpayer (in the form of a social security number or employer.

Who Uses A W9 Form

Who Uses A W9 Form

This way, the irs can track payments made to independent contractors and other people who are not employees.

What is a W9 Form and How is it Used?

How to complete IRS W9 Form W 9 Form with examples YouTube

What is a W9 and Do I Need One?

How to Fill Out Form W9 for a Nonprofit The Charity CFO

Form W9 for Nonprofits What It Is + How to Fill It Out

What Is a W9 Tax Form? H&R Block

The W9 Requirement Libsyn

All About Form W9 What It Is And How To File It 1800Accountant

IRS Form W9 Request for Taxpayer Identification and Certification Legacy Tax & Resolution Services

What Is a W9 and How Is It Used? How To Fill out A W9 Form