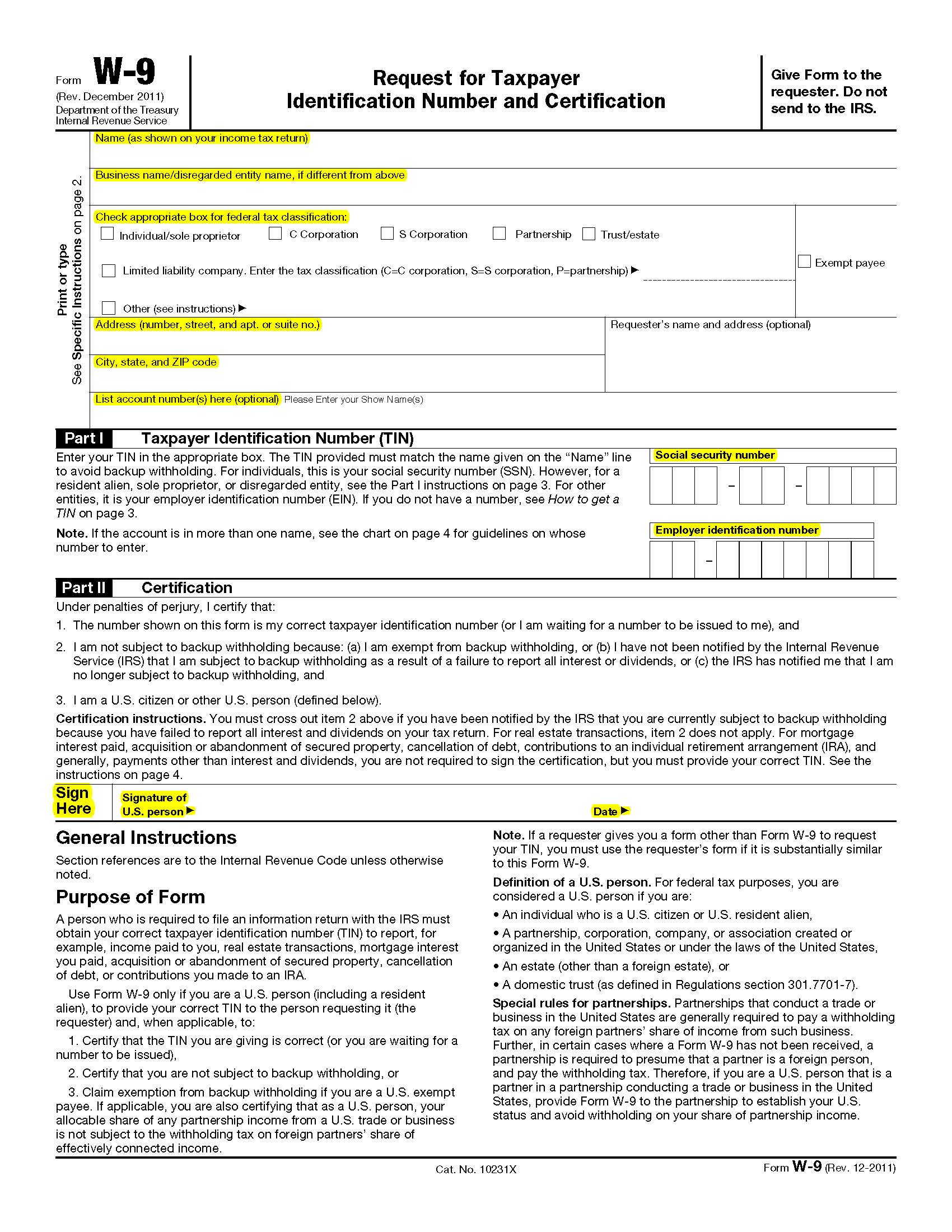

Who Should Use A W9 Tax Form – Providing a correct taxpayer identification number is important — it helps the irs determine who the taxpayer is. This form is necessary for accurate reporting of payments a business made to the vendor, contractor, or business. This article examines the differences between these forms and who should use each one. It is not used to collect taxes.

Tax system, each tailored to the taxpayer's status and income type. The form is also relevant for corporations, partnerships, and trusts in cases involving investment income or dividends. If you're one of those contractors, you can expect to receive a 1099 form to report your income at the end of the tax year. Contributions you made to an ira.

Who Should Use A W9 Tax Form

Who Should Use A W9 Tax Form

Acquisition or abandonment of secured property. Understanding which form to file is key to avoiding penalties and optimizing tax obligations.

How to Fill Out Form W9 for a Nonprofit The Charity CFO

How To Fill Out Form W9 YouTube

What Is a W9 Form? How to file and who can file

:max_bytes(150000):strip_icc()/filling-out-form-w9-3193471-v2-5b733961c9e77c00572ddf88-008a20358ffc40d98c451e6cdea43c21.png)

IRS Form W9 What Is It?

IRS W9

How to fill in W9 tax form and securely sign it using DocuSign — Plumsail Documents Documentation

.webp)

How To Fill Out a W9 Form In 2024 — PDFliner's Detailed Guide

The W9 Requirement Libsyn

:max_bytes(150000):strip_icc()/Investopedia-terms-w-9-edit-b52cc61f47044a94aa85d19ccdbeb7af.jpg)

What Is a W9 Form? Who Can File and How to Fill It Out

All About Form W9 What It Is And How To File It 1800Accountant