W9 Form 2025 Purpose – Read on for the details. First, the payor is required to begin withholding taxes from future payments. As of 2025, the current withholding rate is 24%. This could lead to penalties and delays in receiving your earnings.

This form plays a vital role in the tax reporting process, especially for independent contractors and freelancers. Know the purpose of each form. It's increased to $13.99 million in 2025, up from $13.61 million in 2024.

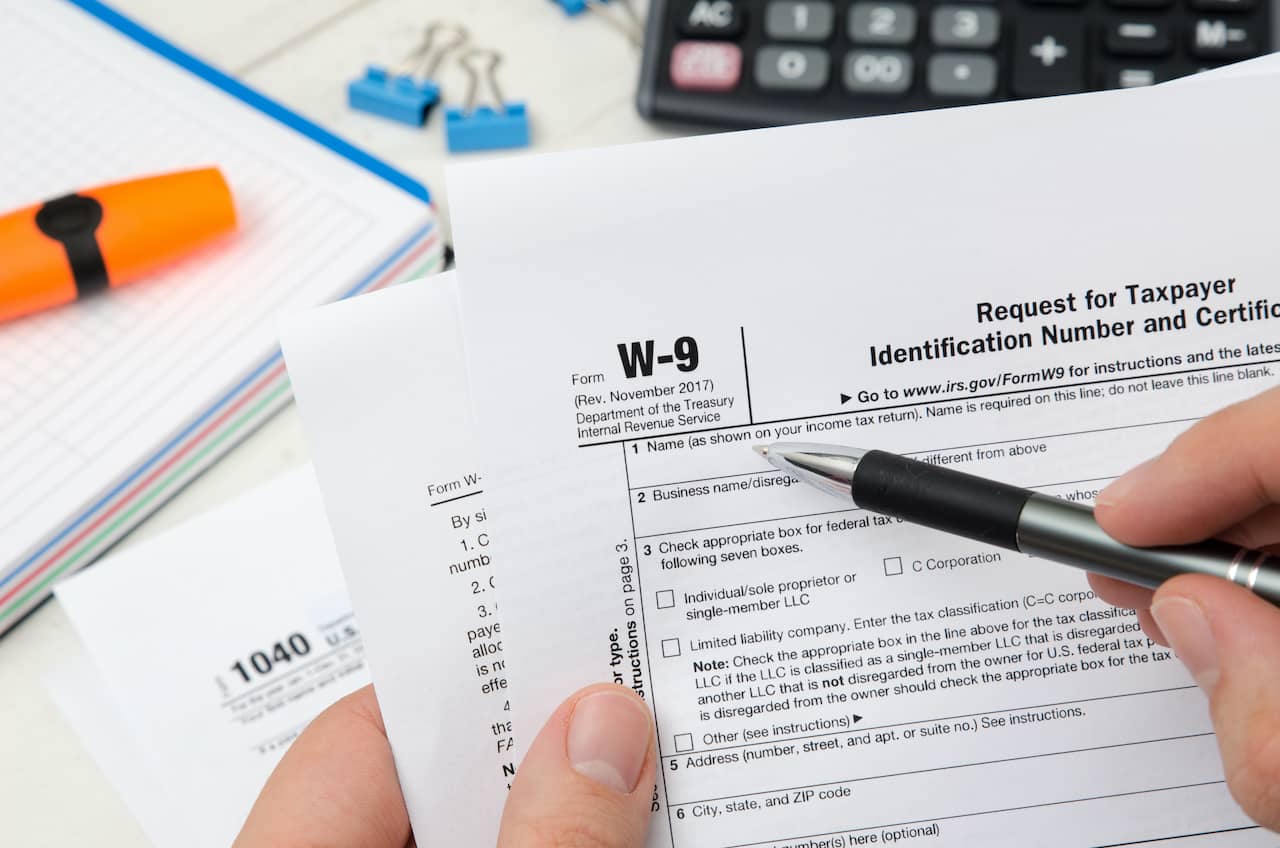

W9 Form 2025 Purpose

W9 Form 2025 Purpose

Its main purpose is to ensure that individuals and entities are correctly reporting income paid to them. Failure to provide a completed form w9 can result in backup withholding, where the payer withholds taxes from your payments. Verify with the requester if you're unsure which form to use.

How to fill out a w9 form for individuals or independent contractors is very similar. It’s an official request from the internal revenue service (irs) for your taxpayer identification number (tin). Exceptions when to not submit a w9 form 2025.

How to fill out IRS W9 form 20242025 PDF PDF Expert

Form W9 for Nonprofits What It Is + How to Fill It Out

1099 vs. W9 Which Is Better for Employers and Why? LendThrive

:max_bytes(150000):strip_icc()/Investopedia-terms-w-9-edit-b52cc61f47044a94aa85d19ccdbeb7af.jpg)

What Is a W9 Form? Who Can File and How to Fill It Out

What Is a W9 Form? Who Can File & How to Fill It Out 2025

IRS Form W9 Form for Independent Contractors to Fill Out

IRS W9

How to Fill out a W9 Form FreshBooks

All about W9 Form What It Is, What It Is Used for, and How to Fill It Out

Free IRS Form W9 (2024) PDF eForms