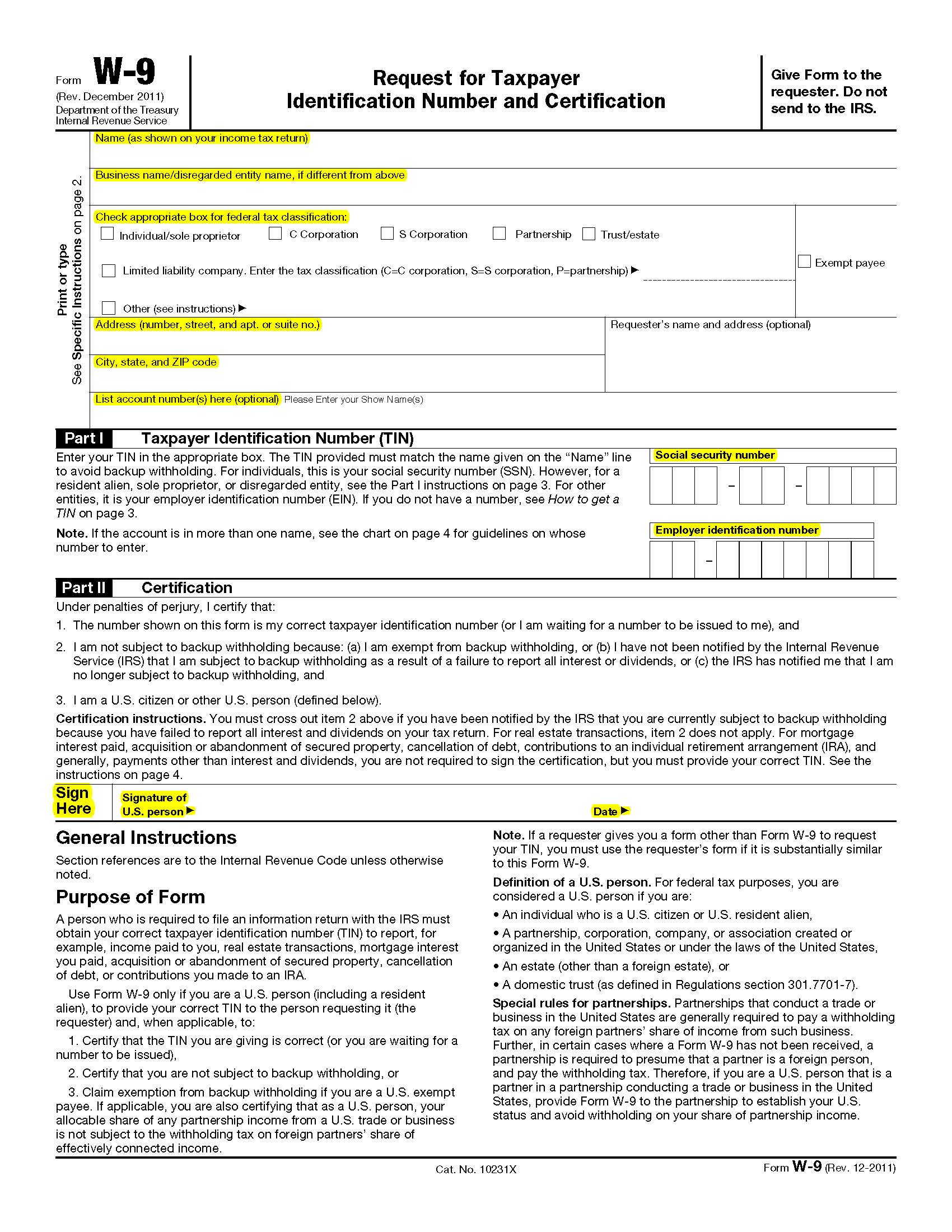

Fill In Form For W9 – Once you have the form, enter your basic personal information, like your name and address. Person (including a resident alien), to provide your correct tin. It's not a tax return. Still, it's important to fill it out correctly to avoid backup withholding and other penalties, including a $50 penalty from the irs for failure to provide a correct tin.

But because you're not sending it to the irs, you need to be careful about who exactly you send it to. Do you have to pay taxes on w9? The form asks for information such as the ic's name, address, social security number (ssn), and more.

Fill In Form For W9

Fill In Form For W9

How to Fill Out Form W9 YouTube

How to Fill Out Form W9 for a Nonprofit The Charity CFO

:max_bytes(150000):strip_icc()/filling-out-form-w9-3193471-v2-5b733961c9e77c00572ddf88-008a20358ffc40d98c451e6cdea43c21.png)

IRS Form W9 What Is It?

What is a W9 Form and Why would a business request one?

W9 for Solo 401k Plan How to Complete W9 for Solo 401k Plan My Solo 401k Financial

How to Fill W9 Form YouTube

Form W9 for Nonprofits What It Is + How to Fill It Out

How to fill in W9 tax form and securely sign it using DocuSign — Plumsail Documents Documentation

The W9 Requirement Libsyn

IRS W9