Failure Of A Company To Issue A W9 Form – If you think the person requesting the form has no business asking for it, though, refusal. If your company pays an individual or business for goods or services, you need to issue a 1099 form to report that payment to the irs. You can provide them with a.pdf copy via email if necessary. Any employee who isn't considered an actual employee of the business should fill out a w9 form.

Contact the contractor again and request the form: Required to submit 1099 forms on time as per the stated deadlines. Inform the independent contractor it is your policy to file the form 1099 with refused listed in the field for the ein and ssn. Also, the information on the form should be used to fill out form 1099s.

Failure Of A Company To Issue A W9 Form

Failure Of A Company To Issue A W9 Form

Failure to comply can result in fines. The 1099 carries the payee's tax identification number, so. Downloadable forms are available through the irs site.

.webp)

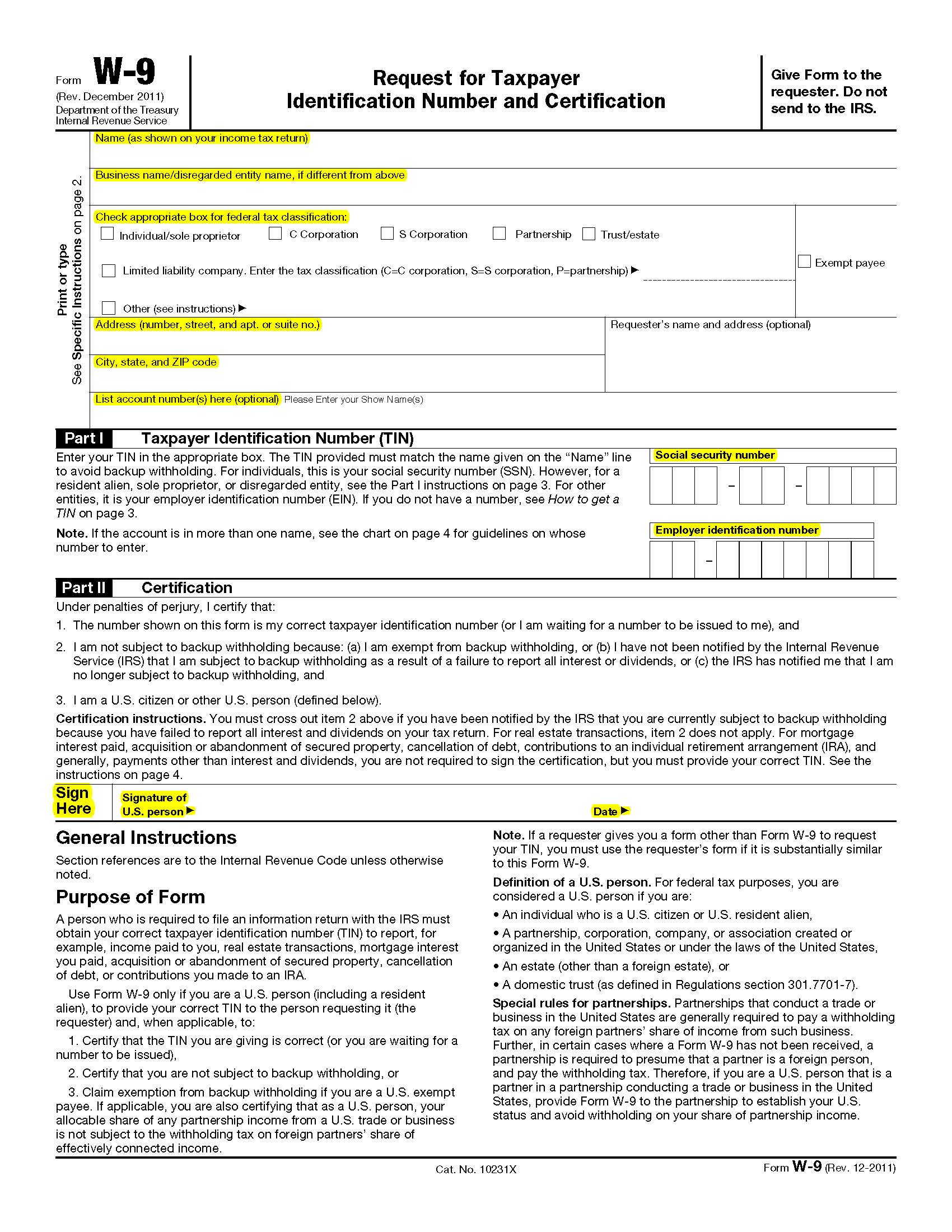

How To Fill Out a W9 Form In 2024 — PDFliner's Detailed Guide

How to Сomplete an IRS Form W9 2023? pdfFiller Blog

What Is a W9 Form? Who Can File & How to Fill It Out 2025

What is a W9 and Do I Need One?

Free IRS Form W9 (2024) PDF eForms

Do You Need a New W9 Each Year? Here's the Answer

.webp)

How To Fill Out a W9 Form In 2024 — PDFliner's Detailed Guide

The W9 Requirement Libsyn

:max_bytes(150000):strip_icc()/filling-out-form-w9-3193471-v2-5b733961c9e77c00572ddf88-008a20358ffc40d98c451e6cdea43c21.png)

IRS Form W9 What Is It?

You're Asked For An IRS Form W9, What Should You Say?