Do You Have To Pay Taxes On A W9 Form – How do taxes work with w9? Contributions you made to an ira. Rather, it is the payee's responsibility to claim the. You are responsible for ensuring the right amount of taxes are paid to the irs.

And when it comes to social security and medicare taxes, you have to pay both the employer and employee's share. Do you have to pay taxes on w9? This form serves as a guideline and gives the employer the information needed to fill out a form 1099 at the end of the year. You can also use another secure delivery method, such as hand delivery or regular mail.

Do You Have To Pay Taxes On A W9 Form

Do You Have To Pay Taxes On A W9 Form

Most individuals and businesses are exempt from this reporting requirement. Acquisition or abandonment of secured property. It's not a tax return.

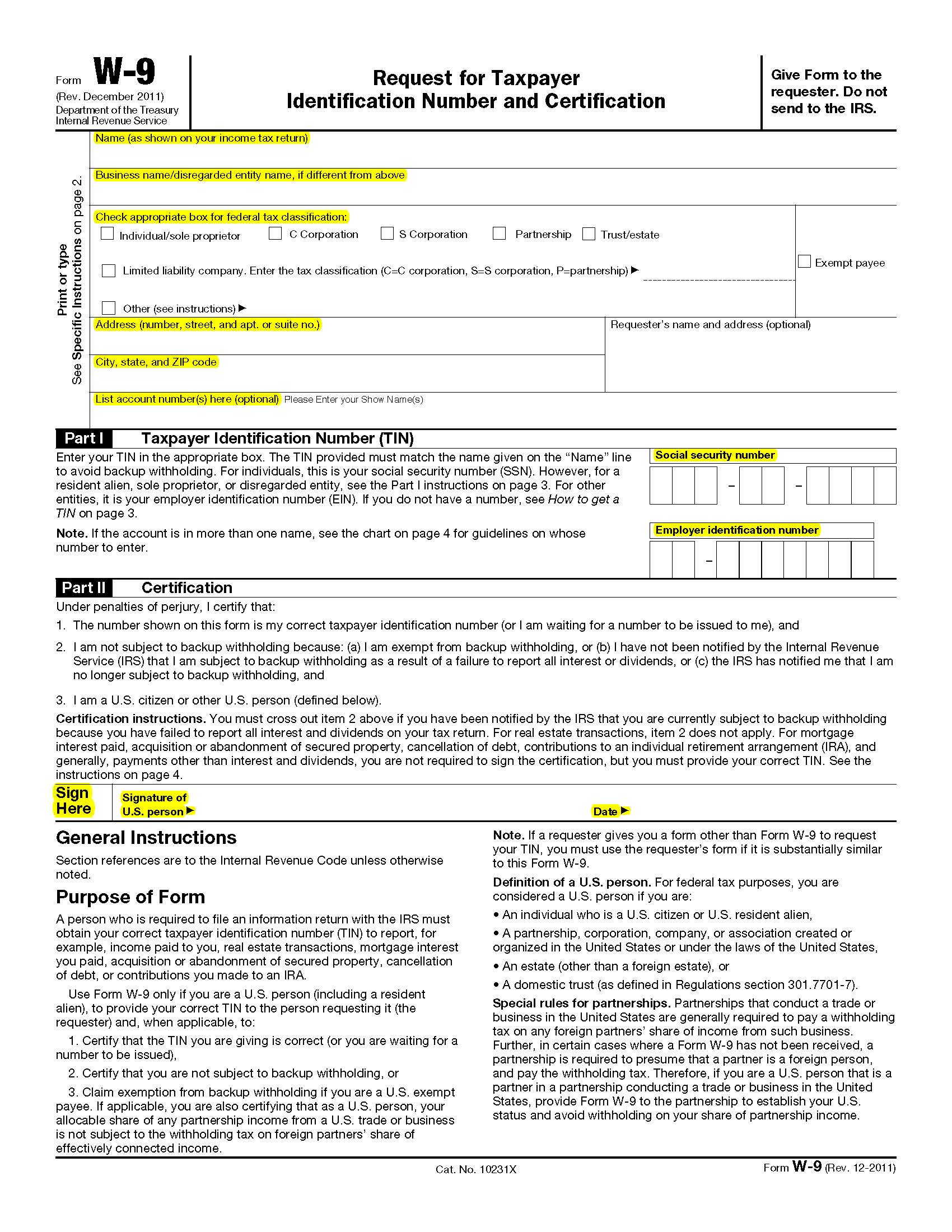

What is a tax form W9? Explore its purpose and when it is used in our guide Blog

How to complete IRS W9 Form W 9 Form with examples YouTube

Guide to IRS Form W9 Request for Taxpayer Identification Number

What Is a W9 Form? Who Can File & How to Fill It Out 2025

The W9 Requirement Libsyn

W9 vs. 1099 Form What is the difference? Skuad

:max_bytes(150000):strip_icc()/Investopedia-terms-w-9-edit-b52cc61f47044a94aa85d19ccdbeb7af.jpg)

What Is a W9 Form? Who Can File and How to Fill It Out

W9 Tips Thread

What is a W9 and Do I Need One?

W9 Forms Everything You Need to Know About W9 Tax Forms