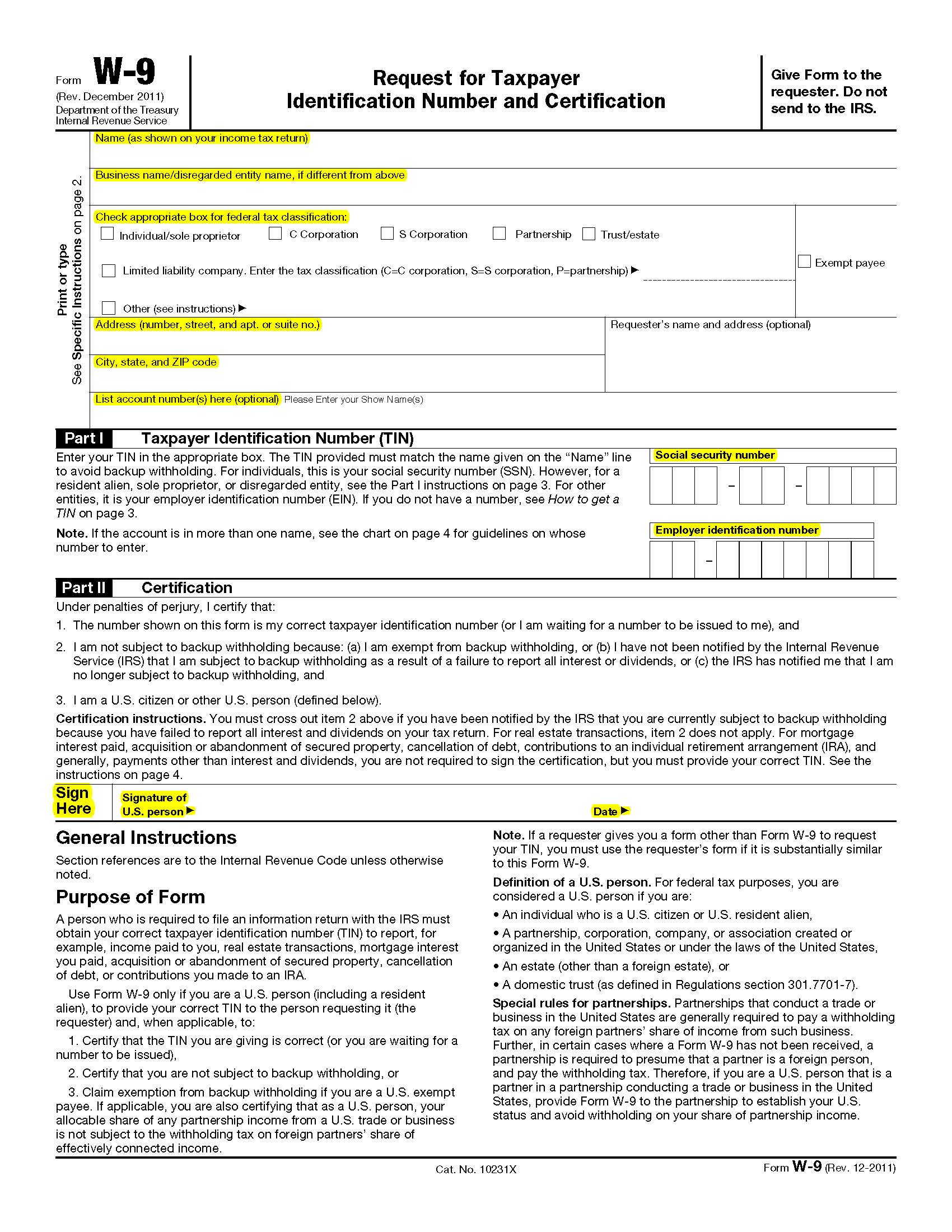

Current Irs Form W9 – It is commonly required when making a payment and withholding taxes are not being deducted. Other federal individual income tax forms: We will update this page with a new version of the form for 2026 as soon as it is made available by the federal government. If you are a u.s.

This form is used by businesses and individuals when hiring independent contractors, freelancers, or vendors to ensure proper tax reporting and withholding. Tax reporting system and helps facilitate proper income reporting between businesses and their contractors, vendors, and service providers. This form is for income earned in tax year 2024, with tax returns due in april 2025. For federal tax purposes, you are considered a u.s.

Current Irs Form W9

Current Irs Form W9

This tax document enables enterprises to collect accurate information for reporting payments to the internal revenue service (irs). We'll go into more detail on that below.

Form W9 for Nonprofits What It Is + How to Fill It Out

.webp)

How To Fill Out a W9 Form In 2024 — PDFliner's Detailed Guide

What is IRS Form W9? Who needs to file it?

Form W9 (Rev. March 2024)

The W9 Requirement Libsyn

How to Complete an IRS W9 Form YouTube

.webp)

How To Fill Out a W9 Form In 2024 — PDFliner's Detailed Guide

Form W9 for Nonprofits What It Is + How to Fill It Out

W9 Form When and Why to Use It Harvard Business Services

:max_bytes(150000):strip_icc()/Investopedia-terms-w-9-edit-b52cc61f47044a94aa85d19ccdbeb7af.jpg)

What Is a W9 Form? Who Can File and How to Fill It Out