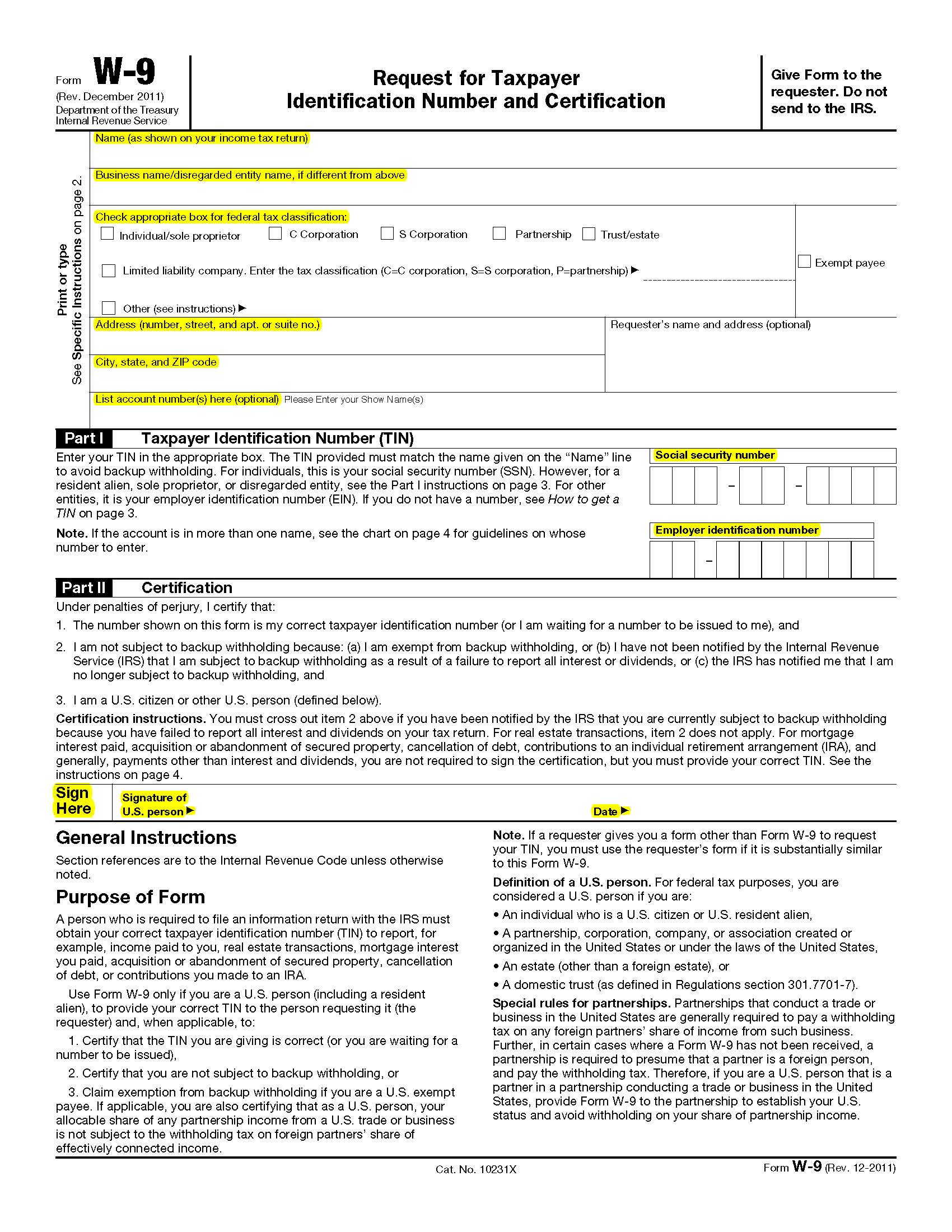

A Corporation Gave Me A W9 Form – Give form to the requester. Do not send to the irs. The form requires an individual to provide their name, address, tax qualification, and withholding requirements. Give form to the requester.

Do not send to the irs. The first request should take place initially upon starting a business relationship. This form serves as a guideline and gives the employer the information needed to fill out a form 1099 at the end of the year. Enter the tax classification (c = c corporation, s = s corporation, p = partnership) on page 3.

A Corporation Gave Me A W9 Form

A Corporation Gave Me A W9 Form

You can provide them with a.pdf copy via email if necessary. The easiest way to do this is via email. Enter the tax classification (c = c corporation, s = s corporation, p = partnership) on page 3.

How to Fill Out Form W9 for a Nonprofit The Charity CFO

Form W9 and Taxes Everything You Should Know TurboTax Tax Tips & Videos

:max_bytes(150000):strip_icc()/filling-out-form-w9-3193471-v2-5b733961c9e77c00572ddf88-008a20358ffc40d98c451e6cdea43c21.png)

IRS Form W9 What Is It?

What is Form W9 and How Does It Help Me With Form 1099?

How to Complete Form W9 For Sole Prop, LLC, S Corp & Partnership YouTube

How to Fill Out a W9 for an LLC StepbyStep

W9 Form Filing Philip Stein & Associates

The W9 Requirement Libsyn

What is a tax form W9? Explore its purpose and when it is used in our guide Blog

Form W9 for Nonprofits What It Is + How to Fill It Out